🌈🛸📈 Fantasy Venture NFT Portfolio

Note: This is not financial advice, and the views expressed in this blog do not represent the views of my firm Sfermion.

This full post is too long for email so click here to go to Substack and view the whole thing

Inspired by Turner Novak’s VC fantasy portfolio, I decided to create a fantasy portfolio for the NFT ecosystem. Please note that I am not including companies that have investable NFT assets (I do make one exception), as that is something Sfermion covers.

This blog is meant to be fun and should not be taken very seriously. If I did not include your company, please do not be offended. There are so many amazing NFT-related companies that I would want to invest in, but this blog turned out way longer than expected and had to stop somewhere.

I will cover five companies, dive into their products, and explain why I think they are excellent. This list of companies will join my fantasy venture capital portfolio, and I will reassess how they perform over the coming years.

If you like this type of content then subscribe to this newsletter!

Today’s blog is sponsored by Async Art. Async Art is a new blockchain art movement where people can create, collect, and trade programmable art. Programmable art is made with "Layers", which you can use to affect the overall image. Art that can evolve over time, react to its owners, follow a stock price, change with the weather, it is now all possible with programmable art.

This month Async Art has two big events. Micah Johnson's art piece "ˈsä-v(ə-)rən-tē" (pronounced sovereignty) will be changed to allow BTC donations that go directly to the children in the art piece. Then there is an amazing collab between Trevor Jones and Alotta money's for their upcoming piece titled “ETH Boy.”

Check out all the incredible art at - https://async.art/

Again, this is meant to be fun and not super serious.

To start us off, here is the cheeky TL;DR version of why these companies are first-rate:

OpenSea: The Amazon, and potentially the Facebook, of NFTs (but back when Facebook was cool)

SuperRare: Curated “who’s who” of the crypto art world

Async Art: Ultra high-end programmable crypto art

NFTfi: Worldwide loan platform

Larva Labs: Two geniuses in the laboratory

OpenSea

It’s hard to express how bullish I am on OpenSea. Whenever I think about the future of OpenSea, I really only consider two things:

1) “Who will acquire them?” and

2) “How will this affect them when they go public?”

I can safely say that I believe OpenSea will become the first NFT-related “unicorn” (a company that reaches a $1B valuation) as long as they keep up what they are doing.

So, what exactly are they doing? A whole lot. They serve as:

The number #1 spot for all NFT trading

A trade activity feed

A place to show off NFTs

A data resource

A place to inspect other users’ wallets

I am currently in the process of writing an entire blog focused solely on the reasons why I am so bullish on OpenSea, but I will try to hit the major points here.

Founded in December 2017 by Devin Finzer and Alex Atallah, OpenSea is a Y-Combinator-backed peer-to-peer marketplace for crypto goods. While this is an accurate description, OpenSea is much more than that. Their “Rankings” page serves as the NFT CoinGecko: it allows users to see how all projects are performing based on trade volume, number of holders, average price, etc. The OpenSea “New” tab allows users to discover all types of new NFT projects. The “Activity” page serves as the ecosystem’s trade activity feed, allowing users to see in real-time who is buying what and for how much. The “Create” tab is perhaps the most important because it allows anyone to open a storefront: users can create their own NFTs and put them up for sale.

If OpenSea went away tomorrow, the entire NFT ecosystem would be in complete turmoil. The majority of NFT projects host their NFT images and metadata on OpenSea (everyone except fully on-chain projects, like Avastars). In fact, the majority of websites showing NFT-related data today are pulling their data from OpenSea’s API. Many NFT projects offload their “marketplace” to OpenSea so their developers can focus on a specific product instead of building an entire native marketplace.

If being a Y-combinator company is not impressive enough, OpenSea has raised a total of $4.1M from incredible investors like Founders Fund, 1confirmation, Coinbase Ventures, Blockchain Capital, and more.

How Does OpenSea Make Money?

I always ask this simple question, especially in this day and age of billion-dollar companies that are completely unprofitable. OpenSea makes money from charging a 2.5% transaction fee on traded NFTs. This is the lowest fee in the industry, as most platforms charge fees between 10-20%. Even if OpenSea decided to raise their fee to 3.5%, I doubt it would impact their platform in a significant way.

Things OpenSea Needs Work On

This one is tough because I feel like OpenSea is always five steps ahead of me. Whenever I reach out to Devin or another team member to ask if they will ever release X feature, he sends back some mockup of that exact feature being built. If I contact the team to tell them some link is broken or data is not showing up, within an hour it is fixed. When Ben Nolan, the founder of Cryptovoxels, does a parcel sale and “breaks” the entirety of OpenSea, it is back up and running within a few minutes. They are simply on top of their stuff.

Things OpenSea Could Add

OpenSea could add a “wallet follow” feature so users could monitor other users' activity, which is something I often try to do. They could also add a direct message (DM) feature since currently many people, including myself, negotiate buys and sells through Twitter. Adding this feature directly to their platform would be amazing. Along those same lines, they could add a project chat room feature, allowing projects to manage their own communities directly on OpenSea instead of on Discord. Adding just these two features (DM and community chat rooms) would instantly turn OpenSea into a social platform and add immense value. Of course, by becoming a social platform as well as a marketplace would add in all these new headaches but in my opinion, it will eventually be worth it. And finally, OpenSea could add better historical data. For example, I can currently see how many wallets own a specific NFT, but I am unable to see the growth of that number over previous days, weeks, or months.

To sum up why I am bullish on OpenSea:

Everyone in NFTs trades on their platform.

Everyone uses OpenSea to search wallets.

OpenSea added data so the information buyers and sellers need is conveniently onhand.

They are an experienced team that ships updates like crazy.

If there is a technical issue, big or small, they are immediately on it.

There are in a market with an unbelievable total addressable market size (NFTs encompass art, video game items, virtual worlds, domain names, collectibles, etc.).

OpenSea’s semi-decentralized infrastructure means it is accessible to anyone in the world.

The second they add DM features and project chat rooms, they will instantly become a type of social media platform.

A crypto analogy for OpenSea is that it is a combination of Coinbase (trading), CoinGecko (data), and Etherscan/Twitter (social barometer, meaning users can inspect someone's wallet to determine if they should keep an eye on them).

SuperRare

When you see people on social media gushing about how a product or service has changed their life, it’s a clear sign to take a deeper look.

SuperRare was founded in April 2018 by John Crain, Charles Crain and Jonathan Perkins. Many people equate NFTs with crypto art, and with that being the case, SuperRare is sitting in an excellent position. Many people coming into the NFT space today might look at SuperRare and assume the platform was an overnight success, but that's far from the truth. The team has been grinding and nonstop hustling for years to get to the position they are at today. If you look at the below chart showing SuperRare’s sales volume, you can clearly see this is true.

Through this hard work, SuperRare has become the top destination for crypto artists and collectors.

SuperRare does not just let anyone join their platform. They specifically curate artists to make sure they are of a high caliber. When I was new to the NFT space, I thought the decision to not let everyone join was terrible, but I have completely flipped. I now know that there will eventually be so many NFTs, curation will be necessary to avoid option and information overload.

The SuperRare website is clean, simple, and resembles a gallery. The “Market” tab is where all the action goes down: users can see art, artists, prices, and all types of information. The “Activity” page gives users real-time updates on what is selling on the platform.

Then, we have the “Notifications” and “Profile” pages. The Profile page unlocks the most powerful characteristic of NFTs - their social nature (I would link them but they are specific to users so you need to be signed in). The page has “Following” and “Followers” numbers, turning SuperRare into an art and social platform. The platform becomes much more sticky by making the experience social.

One of my favorite parts about SuperRare is its “Top Collectors” and “Top Artists” pages. By inspecting these two pages, users can quickly gain insights into what is happening in the broader crypto art scene. If SuperRare wanted to really dominate the crypto art data scene, they could start showing sales from other crypto art platforms - but admittedly that would cause some users to spill over into those other platforms. With SuperRare’s current dominant position, there is no need to do so.

SuperRare has raised around $1.4M in their seed round, but I do not know what they raised from their pre-seed. Let's assume $250,000. That would mean their total funding is somewhere around $1.65M.

How Does SuperRare Make Money?

SuperRare takes a 15% fee on all primary sales, and then a 3% fee on secondary sales. These fees are slightly higher than other crypto art platforms, but SuperRare can do this because it is in a dominant position. For comparison, here are the primary and secondary fees of other NFT platforms:

Async Art: 10% primary, 1% secondary

MakersPlace: 15% primary, 2.5% secondary

KnownOrigin: 15% primary, 3% secondary

Things SuperRare Needs Work On

SuperRare has a search function that I would like to see improved. If I type an artist's name, it will go directly to their pieces instead of their profile. It would be nice to have their profile as the very first search result and then their art pieces below it.

I would also love improved bidding tools on SuperRare. Right now, there is no auction timer countdown for sales, and it would be convenient to have one. I find that when I get into a bidding war, I tend to spend more when I see a timer counting down - and I know the other bidder is watching it, too. The more money people spend, the better it is for SuperRare and their artists.

Things SuperRare Could Add

I think a direct message feature would be nice. Currently, users often DM artists on Twitter to discuss the sale price for art listed on the platform. SuperRare could also lean more heavily into the social aspect of NFTs. I’m not sure how that would look exactly, but I think enabling social behaviors around NFTs is extremely powerful. Of course, social interactions introduce other issues, like users engaging in conflict, drama, and the need for moderation, but I think it might be worth it.

To sum up why I am bullish on SuperRare:

They have become the top platform for curated crypto art.

Crypto art will become an incredibly large market, and SuperRare is already positioned at the front of the pack.

The team has shown that they have an immense amount of grit, as they have been working hard for years.

People literally go online and exclaim, “This product changed my life!” That is a very rare and promising sign.

Async Art

Asynchronous Art (commonly called Async Art) is a programmable art platform that was launched in February 2020 by Conlan Rios, Nathan Clapp, and Lisa Liang. This art platform changed the game by allowing art pieces to morph based on what they call “layer changes.”

This means that a piece of art can react to the outside environment. For example, if an art piece features an image of a sailboat in the sun, you can connect the background layer NFT to another “state,” such as a stormy background. When it rains, the stormy background can be activated so that the sailboat in the sun morphs into a sailboat in a storm. I like to say that Async Art has brought the art from Harry Potter to life. In the movie Harry Potter, the paintings talk to the characters and react to the outside world. Now that we have this Harry Potter type of artwork it can enable endless possibilities.

Async Art also does an incredible job telling the story of artists and their art through a “Featured” page. Their most recent feature dives into the story of the artist Micah Johnson and even includes a short video. Even though the video is only one minute long, it does an excellent job teaching us (the collectors) about the artist and his inspirations.

Their platform is also one of the best at working closely with artists and collectors. I do not know of other platforms that work as hard as Async Art does to build such strong relationships with their users. I believe this is due to the high-end nature of their artwork and the fact that programmable art pieces are hard to create. These programmable art pieces take longer to create than non-programmable pieces because instead of a single NFT they are made up of multiple NFTs that change based on different inputs or factors. Async Art launches fewer pieces than other art platforms again, because programmable pieces take longer to make than regular crypto art. This can work in their favor because the pieces on Async are naturally more scarce but there is also an issue. The issue is that since there are fewer total pieces of art, Async has naturally less “marketable material” when compared to other art platforms. I can follow SuperRare and see multiple amazing new art pieces every single day but on Async there are fewer art pieces which means less content to talk about. This is part good for Async, because people like scarcity, but also part bad because attention spans are short on the internet and people always want more content.

How Does Async Art Make Money?

Async Art takes a 10% fee on primary sales and a 1% fee on secondary sales. These fees are some of the lowest in the crypto art world. Again, here are the primary and secondary fees of other NFT platforms for comparison:

SuperRare: 15% primary, 3% secondary

MakersPlace: 15% primary, 2.5% secondary

KnownOrigin: 15% primary, 3% secondary

I expect these fees to come down over time. That is unless one of these platforms builds such a strong network effect that they can begin to dictate their own fees without looking at competitors.

Things Async Art Needs Work On

Their website layout is slightly confusing. I find it difficult to search for specific artists or art pieces. The bidding tools on Async are also a bit lacking, and thus users do countdowns for their auctions on Twitter instead. Async seems focused on building amazing tools for artists, but they must ensure that their user experience is top-notch to match those incredible tools.

Things Async Art Could Add

I would love to see better search functions for both artists and art pieces. I am always pushing towards the social angle of NFTs, so I would also love a direct message feature to enable artists and collectors to speak directly. Direct communication is currently happening on Twitter, Discord, email, etc., so it would be nice for them to capture it.

To sum up why I am bullish on Async Art:

They completely changed the art game by enabling programmable art.

They are superb at building lasting relationships with artists and collectors.

Async Art is viewed as an “ultra-high-end” art platform, which is an advantageous position to be in for an art market with global reach.

Of course, the Async Art team is stellar. I know Conlan and Nathan well, but unfortunately not Lisa - although I have only heard good things.

NFTfi

Note: I am an investor in NFTfi.

I am not sure if anyone reading this has experienced this problem, but I keep getting disqualified for a mortgage because the vast majority of my net worth is in crypto. Lenders (at least here in the States) do not accept crypto as real assets. With the launch of NFTfi, this problem is no more!

Launched in June 2020 by Stephen Young, NFTfi is a marketplace for NFT-collateralized loans. This single product instantly enabled millions of NFTs that were sitting passively in wallets to have another major use.

It's difficult for us to understand how large the potential market is for a platform like NFTfi. In the physical world, it is quite difficult for people to take out loans using goods as collateral. Using a house as collateral is probably the most common and easiest but there are still mounds of paperwork and hoops to jump through in order to take out a loan. Another common good that is often used as loan collateral is expensive art. This is generally for ultra-high net worth people so not nearly as common as home collateralized loans but does showcase other goods people use as loan collateral. What if we could take out loans using all sorts of goods, like computers, computer desks, or kitchen appliances? NFTfi opens up the loan market to allow people to use literally any NFT as collateral. Imagine people using things from a house to your kitchen fridge as loan collateral. All that paperwork and all of those arduous approvals needed? This loan market is completely open for all and the participants get to decide if they want to lend against certain goods.

Another factor that I love about NFTfi is its simplicity. Users enter the website and are directed to click either “lend” or “borrow,” and from there the platform is very intuitive. When a user clicks on an NFT under the “lend” option, they can enter the loan amount, repayment amount, and loan duration. Once you input the parameters and make the offer, the other party will be notified and can either accept the terms or just ignore them. This ultra-simple approach to the loan process opens the door for users of all skill levels to participate in the platform.

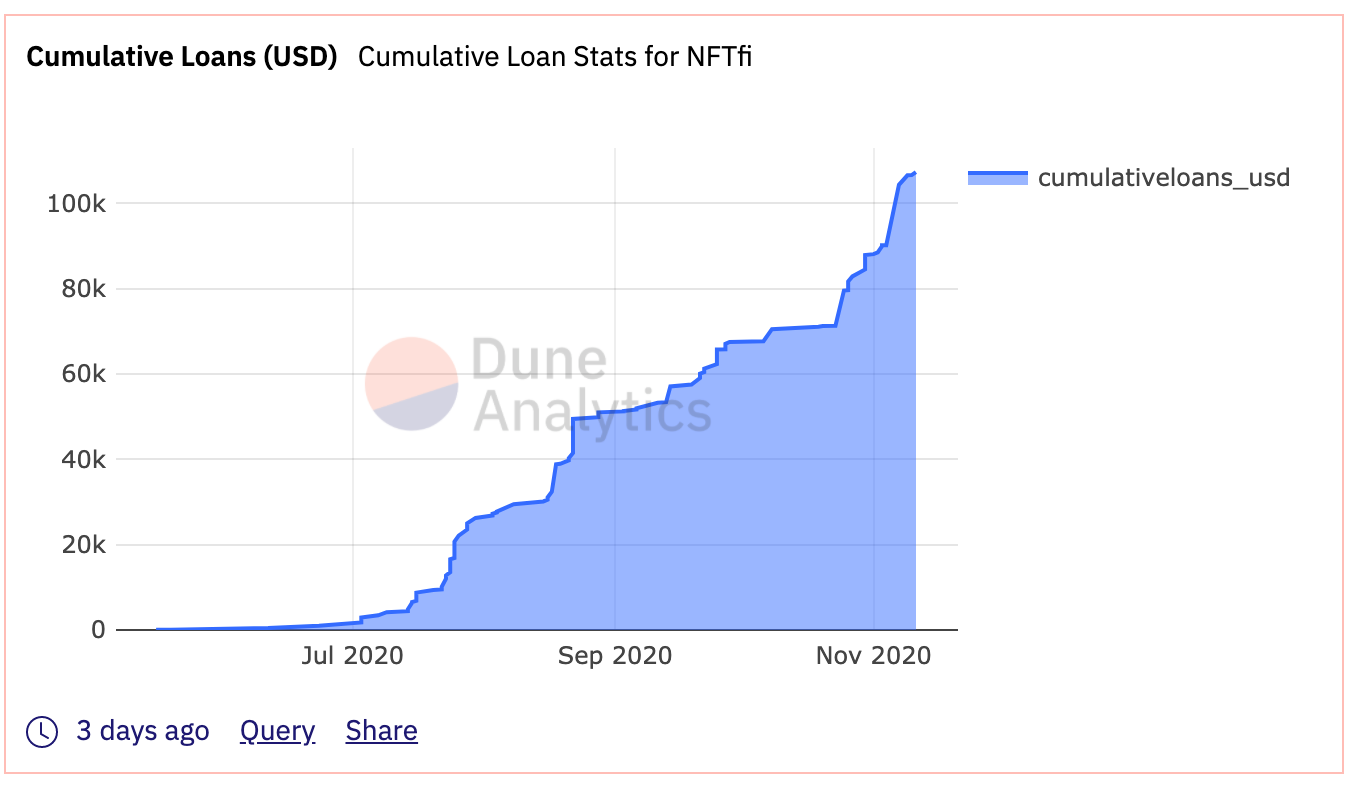

Since NFTfi’s June launch, their loan volume has been increasing rapidly.

I expect 2021 will be a huge year for NFTfi, and predict their total cumulative loan value will reach tens of millions of dollars.

How Does NFTfi Make Money

NFTfi makes money by taking a 5% fee on loan interest, and I think this is extremely fair towards the market participants. It eliminates barriers for anyone borrowing because they only pay the specified interest with no hidden fees and that 5% fee is low enough to not hugely impact the lender.

Things NFTfi Needs Work On

NFTfi already executes its main use case, NFT collateralized loans, very well. The tech works and there are users. The only thing NFTfi needs to focus on now is bringing more users to the platform. There needs to be more assets available for loan collateral and they need more users with excess crypto that want to earn passively. The main issue stopping wealthy crypto holders from lending more is education on what values they should lend to different NFTs. If you are new to the NFT space it is hard to give fair loans to users because discovering “fair market value” is difficult.

Things NFTfi Could Add

I would love to see basic statistics relevant to my own account, such as profit and loss, the number of loans taken out, total value borrowed, total value lent, etc. That information would not only help users keep better records, but also become much more valuable over time as other platform uses could spawn from this data. Once the platform has more users and data, NFTfi will be able to give wallets and provide credit ratings, allowing users to make better decisions on who to lend to if they know a borrower has paid back all of their loans.

To sum up why I am bullish on NFTfi:

It allows users to take out loans with NFTs.

It allows users to earn income from loaning out crypto.

It taps into an absolutely massive potential market size (NFTs = everything, so NFTfi is an everything-collateralized loan platform).

The design of the platform is simple and easy to understand.

The marketplace is open for users to choose how much they want to offer for loans.

Fees are very low, which encourages users to be active.

And of course, the founder Stephen is incredibly smart and talented.

Larva Labs

Okay, I know what you are thinking: “Larva Labs is not a startup, it's some type of software development studio!” And you are right. From my understanding, they have no want or need to raise capital for what they are building, but if they ever did, I would literally beg them to take my money.

Created in 2005 by two geniuses named Matt Hall and John Watkinson, Larva Labs has been working on all types of software since their inception. To get a view on just how diverse their skillset is, take a look at their website, which discusses the various projects they have worked on:

Large scale web infrastructure

Genomics analysis software

8-bit roleplaying games

Art project on the blockchain

Largest open-source repository of legal documents

Endless driving game

App for Android called AppChat

Two different versions of a completely new Android homescreen experience

Motion tracking dance booth

App with Google called Androidify

To say these two are talented is the understatement of the century - they are freaking brilliant. So, how do they relate to the NFT ecosystem? They created the first NFTs on Ethereum called CryptoPunks. Then, they created another well-known and highly valuable NFT project called Autoglyphs.

When Matt and John first created CryptoPunks, NFTs were not really even a thing. The ERC721 standard that enables people to easily create NFTs did not exist yet, and previous NFT projects had been built on the bitcoin blockchain using Counterparty. These previous NFTs were limited to meme images called Rare Pepes. Counterparty and Rare Pepes did not gain popularity and fell out of use. Luckily, Matt and John continued their hard work and in June 2017 launched CryptoPunks.

CryptoPunks are a series of 10,000 unique pixelated characters on the Ethereum blockchain. Each CryptoPunk is totally unique and contains traits that vary in rarity. This project has become a huge success, and today CryptoPunks are a highly sought after collectible. In April 2019, Matt and John launched their next NFT project, Autoglyphs. Autoglyphs are the first on-chain generative art on Ethereum and are highly sought after collectibles.

Things Larva Labs Needs Work On

Matt and John don't really need to work on anything. They are creating products more akin to art than software with a specific function.

Things Larva Labs Could Add

Their existing products and accompanying web pages are great. The only thing Larva Labs should add is their next NFT project.

To sum up why I am bullish on Larva Labs:

Matt and John are both freakishly smart.

They have an amazing track record of success (the first NFT project on Ethereum and two successful NFT projects overall).

Whatever they build tends to be extremely well thought out.

The projects they launch do not require large teams or much maintenance, as their projects are more “art-like” in nature (not like games or virtual world platforms that need constant updates).

There you have it - my fantasy venture NFT portfolio. I will revisit this blog in a year or two and review how the startups and studios on this list are doing.

If you liked this content, please subscribe to my newsletter Zima Red, and give me a follow on Twitter. Stay tuned for more articles on NFTs and all things virtual. 😎