Azuki is having its moment

Plus Axie hack / Looks Rare vs. OS / OpenSea X Solana

Zima Red gives readers the weekly pulse on the biggest news around NFTs. Join our community and take the journey with us by subscribing here:

🎙Zima Red Podcast

Dan Hannum - Crypto Taxes, DAOs, Web3 Investing - Zima Red ep 112

Crypto, defi, DAO, and NFT taxes

How the IRS is spending billions on becoming web3 pros

What it takes to build a great product for the web3 space

How DAOs are evolving from a software and business standpoint

His investment strategy

How reputation is everything

Eric Golden - Transitioning From Billion Dollar TradFi Investments to Web3 - Zima Red ep 113

How he fell down the web3 rabbithole

How he grew his Fidelity business from $0 dollars to having $18b under management

The traditional asset manager business and how it works

Hosting the web3 breakdowns podcast

Why crypto is so alpha rich

How the crypto markets experiences full boom and bust cycles in condensed timelines

US securities laws and how they can co-exist

📈 Market

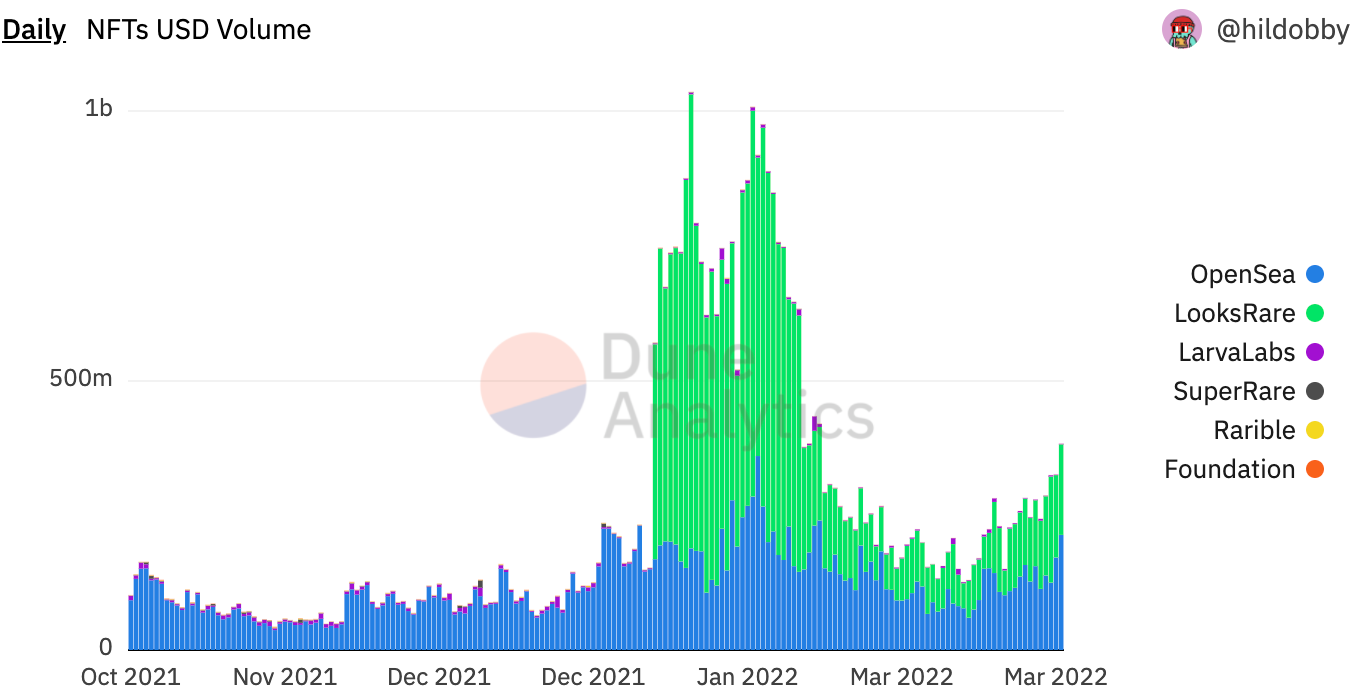

First off, shoutout to @hildobby_ for the awesome Dune dashboards.

Daily NFT volume is trending up

We are also closing on the 5 consecutive weeks where weekly NFT trading volume has outpaced the prior week.

But monthly…

Looks Rare vs OpenSea

Looks Rare has cemented itself as the clear favorite amongst decentralized NFT marketplaces largely due to the $LOOKS earnings trades on its platform provide.

The value proposition makes sense. Sell an NFT for 100ETH on OpenSea and get nothing or sell it on Looks Rare and get like ~$9K in $Looks.

At a glance Looks Rare is neck and neck with OpenSea right now.

Take a look at the volume.

There are plenty of days when Looks Rare outright beats OpenSea in sales volume.

But volume can be misleading. Now check out the actual number of transactions.

Not even close.

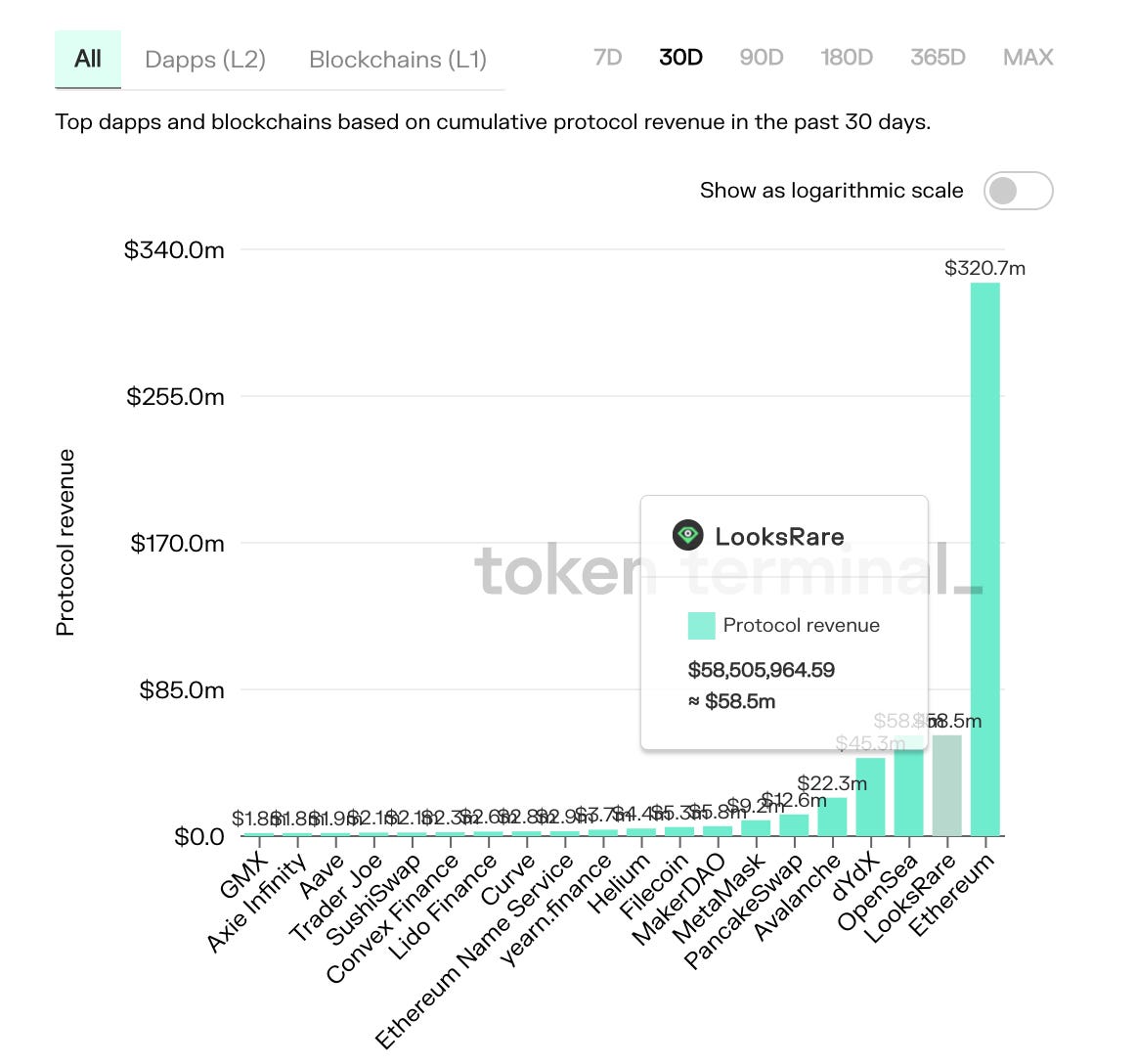

Looks Rare seems to be positioning itself as the marketplace for big sales (and wash trading).. and that’s ok because now let’s look at protocol revenues on token terminal.

Looks Rare has actually edged past OpenSea as the #2 highest-earning protocol in crypto after Ethereum. The bedrock metric of traditional financial asset valuation, price to earnings ratio (P/E) for Looks is 3.6X.

Considering that most crypto assets have double to triple-digit P/E ratios, Looks looks a bit undervalued.

Not investment advice.

📰 Mainstream

OpenSea is rolling out credit/debit card payments for NFTs

As the platform looks to stray further and further away from the light it will begin allowing users to use fiat to pay for NFTs on the site. All jokes aside, OpenSea is clearly looking to position itself beyond the crypto native userbase. With Instagram steamrolling towards establishing an NFT marketplace of its own, OpenSea is trying to make a push to capture the mainstream crowd.

For now, OpenSea will not be offering NFT custodial services so users may be able to buy NFTs with fiat but they will still need a crypto wallet to store them.

OpenSea also basically said that they are integrating Solana NFTs.

In what OpenSea jokingly said was “the best-kept secret in Web,” Solana NFTs are coming to the world’s largest NFT marketplace.

Solana “blue-chips” like Solana MBS and DeGods have watched their floors soar on the news.

With 90% of the Solana NFT sales volume, Magic Eden will be the biggest loser by far.

Magic Eden does still beat out OpenSea on marketplace fees (2% vs. 2.5%) but that probably won’t be enough to keep them from eating into their market share.

👤 Social

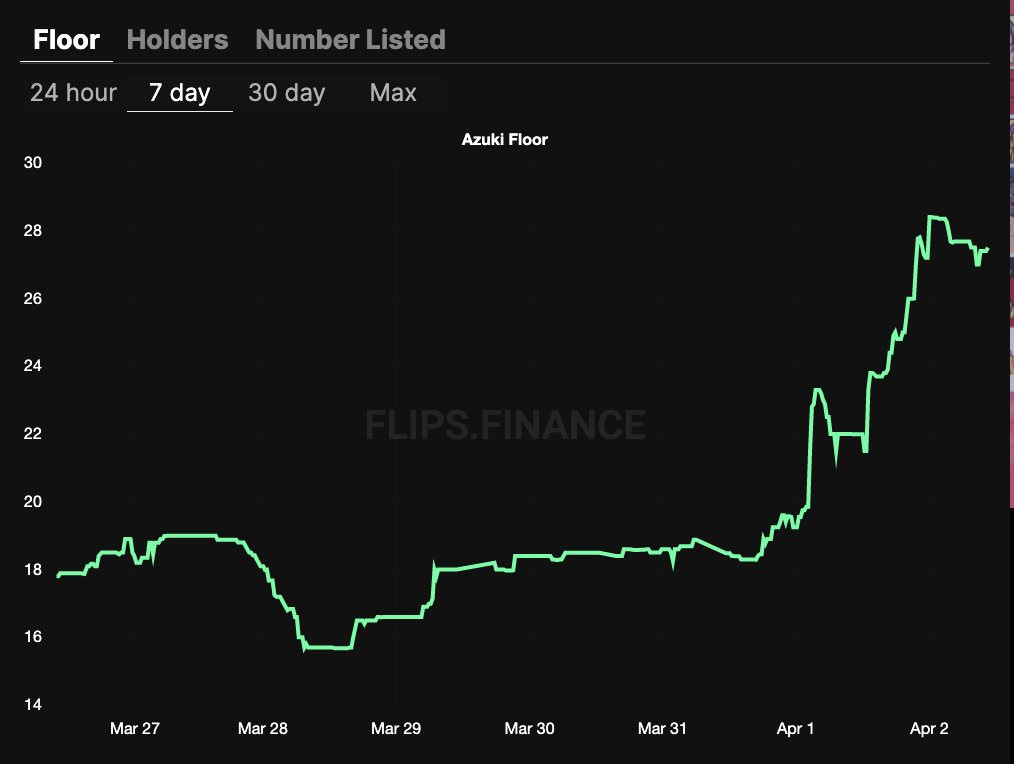

Azuki is having its moment

First came the airdrop, announced last Wednesday at a private NFT LA party. The floor for the airdropped “Something” NFT is now around 5ETH.

Then came the pump. One would expect the base collection to dip roughly equal to the floor of the airdrop but this time…it went up. A lot.

The floor of the base collection actually started to increase on the announcement but didn’t stop even after the airdrop came and went.

Even BAYC corrected slightly after its ApeCoin Airdrop before gradually regaining its former floor and proceeding to go higher.

Azuki is run buy LA-based Chiru Labs.

A few things on them:

Four pseudonymous founders

All with big tech and even Y-Combinator experience

Chiru labs are positioning themselves and their members as “the skaters of the internet” and are following the same playbook of value creation that allowed Yuga Labs to reach a $4 billion valuation.

Kevin Rose’s Proof Collective gets its PfP

Proof collective an NFT community started by Digg founder Kevin Rose and Treehouse founder Chris Carson has already watched the floor of their membership NFT ballon from 6 to 55 ETH this year. But a membership card NFT doesn’t quite have the same signaling and network effect as PfPs.

Enter Moonbirds.

The collection is dropping via a Dutch Auction on OpenSea on April 16th.

The DA will start at 2.5 ETH and has already garnered a ton of hype.

Pudgy Penguins is under new ownership

The Pudgy Penguins founders have been engaged to sell the collection ever since the Pudgy Penguins community voted to oust them back in January. LA-based entrepreneur and Day-1 penguin Luca Nets has purchased control of the projects along with its royalties for $750 ETH ($2.5M).

Despite some mockery in the NFT world, with almost 50,000 ETH in volume and famous holders like Steph Curry, Pudgy Penguins is still a force to be reckoned with. It is now up to Netz to follow through with the roadmap that the project’s founders infamously lagged on.

🎮 Gaming

Axie Infinity developer, Sky Mavis, had $625M stolen

The attackers were able to obtain the private keys of five of Sky Mavis' nine validators to withdraw 173,600 ETH and 25.5M USDC

Four Ronin Validators as well as a third-party validator run by Axie DAO were compromised

What’s surprising is that it took Sky Mavis six entire days to realize that it had been hacked. The attacker was presumably looking to double-dip by taking a short position out against Axie Infinity and Ronin knowing that their price would fall on the news. It took so long for the news to break that this short was actually liquidated.

One interesting note is that the $625M will be almost impossible to withdraw. The thief is moving the funds to different wallets and onto exchanges but cashing out without giving up your identity is very difficult. Sky Mavis working with law enforcement to recover & reimburse the funds. They have noted on-chain sleuth Chainalysis on the case as well.

A repository of basically every blockchain-based gaming project in existence

Hiro Capital’s blockchain gaming specialist, Jon Jordan, compiled an extensive list of the current blockchain gaming ecosystem. The lists important information about each project including social links as well as links to its road map.

🌎 Virtual Worlds

Citibank calls the metaverse the next generation of the internet

The bank’s analysts estimate that the metaverse’s total addressable market could reach $13 trillion by 2030.

To get to these projections, however, CitiBank says the metaverse will need a computational efficiency improvement of over 1,000x today's levels. The analysts stated significant investment will need to be made in the following areas:

computing

storage

networking infrastructure

game development

hardware

They also think the metaverse can reach 5 billion users.

But to get there, the experience will need to tap mobile phone users. Citi estimates a VR/AR-only metaverse would top out at 1 billion users.

🎨 Art

The world's priciest living artist, Jeff Koons, will release his first NFT

Koons, the former commodities broker, who became one of the world’s most renowned living artists with iconic giant steel balloon dogs, is looking to use the crypto moon meme to create a "historically meaningful NFT project."

Koons is even partnering with Intuitive Machines to send a subset of physical pieces to the actual moon.

🎶 Music

20 problems with Music NFTs

Andrew Beal on Music NFTs in 30,000 Feet

💸 Funding

Fractal ($35M) - NFT Marketplace focused on Solana-based gaming NFTs founded by Twitch founder Justin Kan. Fractal's seed round was co-led by Paradigm and Multicoin and included participation from Andreessen Horowitz, Solana Ventures, Coinbase, Animoca, and more.

Cross the Ages ($12M) | a free-to-play fantasy and science fiction game featuring NFT trading cards. Participation from Animoca Brands, Ubisoft, Polygon, Sebastien Borget, and others.

Blur ($11M) - NFT marketplace designed for pro traders. Seed round led by Paradigm with participation from 0xMaki, Santiago Santos, Zeneca, Deeze, Andy (Fractional), eGirl Capital, Keyboard Monkey, LedgerStatus, and more.

SkateX ($5M) - Solana-based video game with NFT skateboards. The round included participation from Coinbase Ventures, Solana Capital, Animoca Brands, Play Ventures, Cadenza Ventures, Kevin Lin, and others.

TeaDAO ($4.6M) - Attempting to solve for NFT illiquidity and enable GameFi 2.0 as a metaverse reserve currency. Participation from Shima Capital, Signum Capital, UOB Venture, PNYX Ventures, HyperChain Capital, Spark Digital Capital, Mapleblock Capital, AU21 Capital, Basics Capital, DFG, X21 Digital, LD Capital, 7 O'Clock Capital, MEXC Exchange, Momentum 6, Jsquare, FOMOCraft Ventures, Parsiq, Newave Capital, CoinW, NFV, ZBS Capital, AVStar Capital, HG Ventures, Satoshi Club, and Token Hunter.

📚 What we’re reading

MultiCoin Capital: In Search of Outliers & How to be Contrarian

🐦 Tweet check

👀 Alpha

Premint - Still available for close to mint price on secondary. NFTs like this do tend to stay around mint price until utility builds. The founder, Brenden Mulligan, is also the founder of PodPage and is very respected in Sillicon Valley.

Like what you read? Let your friends know about Zima Red: