Zima Red gives readers the weekly pulse on the biggest news around NFTs. Join our community and take the journey with us by subscribing here:

“Trevor, I think a bearish newsletter is in order”

- Andrew Steinwold

📉 Andrew’s Market Update

Public markets have been getting demolished, inflation is still high, and the Fed continues to raise rates - things are not looking peachy. Many venture investors are telling founders to get burn rates under control, raise whatever you can, and get to “ramen” profitable ASAP. Despite the carnage in the markets and the bearish macro view that many hold, it is looking like the market is near capitulation according to the Net Unrealized Profit/Loss chart.

Obviously, one chart cannot tell you the future but it can give you a historical look into other periods of max pain. In my opinion (not financial advice) the Fed decides which direction the market will head. Raise rates = market down. Cut rates = market up. Keep close tabs on what they decide.

$LUNA death spiral

Unless you’ve been living under a rock you’ve almost certainly heard that $LUNA has hit basically 0.

So what happened?

The Terra Ecosystem has two tokens: UST and LUNA

LUNA is a Layer 1 blockchain (like Ethereum) but is unique due to its stablecoin, $UST.

Stablecoins are ideally backed in a manner that is 1 stablecoin = $1USD

USDC is the best example of this. 1 USDC will theoretically always be backed by 1 greenback.

The problem with these 1-1 stablecoins is that they are centralized and can be censored by governments/companies.

Enter Luna, a decentralized stablecoin.

1 LUNA always* equals 1 UST

LUNA developers, community, and investors believed that this mechanism would keep UST pegged to $1 USD. The majority of UST’s users came from Anchor Protocol which allowed liquid UST staking at 20%. UST/LUNA critics argued that a significant UST outflow from Anchor would lead to a LUNA death spiral.

A large amount of capital exits UST —> They sell more and more LUNA —> The 1 UST - $1 USD peg breaks —> a bank run triggers a UST and LUNA death spiral.

LUNA attempted to protect against a bank run by buying BTC.

On May 7th-8th, $UST depegged to 98 cents after several $100M was pulled out. The BTC backstop came out and trading firms backing LUNA injected capital to defend the peg.

This brought the peg back up a bit but didn’t hold

More and more funds were pulled out

More LUNA was sold

The death spiral that LUNA backers said couldn’t happen…happened. The end.

Jack Niewold wrote a great thread on this with some more context about Terra’s founder Do Kwon's attempt to save it, as well as attempting to answer the question of…Now what?

Also, the death spiral’s effects weren’t only felt by the Terra holders. Check out this thread to learn some of the second-order consequences.

👤 Social & Collectibles

Zagabond’s “learning experience”

This past week, the Azuki project has been embroiled in drama after one of its four founders, Zagabond, released an article that masqueraded past rug pulls as “learning experiences.”

What went down:

Zagabond dropped an article where he discussed his founding of three projects prior to Azuki:

Phunks

Tendies

Zunks

He described the learning experiences gathered from each project and how they ultimately strengthened Chiru Labs and Azuki.

To most, these “learning experiences” were considered to be rug pulls - i.e. he abandoned the projects.

The backlash incited Zagabond to go on a Twitter Space with Andrew Wang to hopefully explain the situation and clear the air….

…that did not happen

Azuki’s floor started to spiral almost immediately after the Space.

Despite all this… Azuki is back to 13ETH+

Bored Ape #8585 sold for a 500+ ETH loss

You can check the transaction history here

This was probably a self-trade to claim a tax loss but not positive!

Doodles Dooplicator airdrop

Claim here

May 12: Claiming started

June 21st: Claiming ends

June 22nd: Trailer premiering @ NFT NYC featuring the Dooplicator

June 23rd: Traits & rarities revealed

Summer 2022: Dooplication begins

🎮 Gaming

Potential Roblox NFTs

On a call, Roblox's CEO reportedly spoke about the ability to wrap Roblox digital items in an NFT and take them off-platform.

Axie Origin goes live on Android mobile + unveils land staking

Jiho and the Axie team released an overview of land staking:

337,500 AXS per month is dedicated to this initiative

Proof of engagement and gameplay ic required to claim tokens

🌎 Virtual Worlds

Otherside releases a new demo

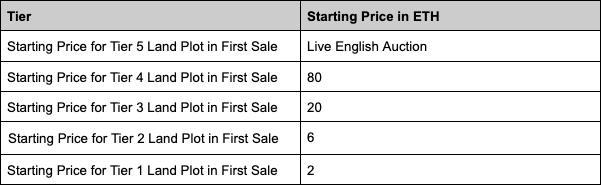

Illuvium land sale

Taking place June 2nd

Dutch auction

Price starts 2ETH

Total supply of 20,000 plots across seven unique regions

~5% of all in-game revenues go to landholders

🎶 Music

Web3 Artist journey

📰 Mainstream

NFTs are coming to Instagram

Instagram tweeted that they are testing ways for creators and collectors to share NFTs on the platform.

Some details:

They have begun testing the product with select creators

Rainbow wallet will be supported

The platform will support Ethereum and Polygon NFTs initially before adding support for Solana and Flow

Sorare signs deal with Major League Baseball

The MLB has reached an agreement with the NFT-based fantasy sports company, Sorare. Similar to Sorare’s agreements with European soccer, this deal will allow users to collect tokens representing players.

The deal includes an upfront payment guaranteed against future royalties from the sale of tokens

The MLB also has a deal in place with Candy Digital to produce MLB NFT trading cards

💸 Funding

MechaFightClub ($40M) | Combat sports in the metaverse with artificially intelligent NFT fighters. The round included participation from Andreessen Horowitz, Michael Ovitz, Sonam Kapoor, Solana Ventures, The Chainsmokers, Mantis VC, Advancit Capital, KeenCrypto, Capitoria, Unlock Venture Partners, and Infinity Ventures Crypto.

Co:Create ($25M) | A new protocol that provides foundational infrastructure for decentralized brands. The round’s participants include Andreessen Horowitz, VaynerFund, Not Boring Capital, and Amy Wu.

Highlight ($11M) - Platform to build blockchain-based membership communities. The round included participation from Haun Ventures, 1kx, SciFi VC, Floodgate, Coinbase Ventures, Thirty-Five Ventures, Offline Ventures, DAO Jones, Mischief, Polygon Studios, WME, Chris Zarou, Scott Belsky, Tarun Chitra, Mark Gillespie, Robert Leshner, Lenny Rachitsky, Gokul Rajaram, Linda Xie, Lucy Guo, Magdalena Kala, Method Music, A.capital, & 2PunksCapital.

Cometh ($10M) | A DeFi-powered videogame featuring yield generating NFT. White Star Capital, Stake Capital, Serena Ventures, Shima Capital, IDEO Colab Ventures, and Ubisoft all participated in the round.

InfiniGods ($9M) | A blockchain gaming studio. Participation from Pantera Capital, Framework Ventures, Animoca Brands, Jefferson Capital, and Double Peak.

📚 What we’re reading

(Listen) The full Aku story with Micah Johnson

Hey! You made it to the bottom :)