🏛🖼💰Sotheby's Art Valuation Metrics Applied To Unique Digital Assets

Lessons From The World's Top Valuation Experts

Founded in 1744, Sotheby's is the fourth oldest auction house and one of the world’s largest brokers of fine and decorative art, jewelry, real estate, and collectibles. Sotheby’s is a world leader in valuing all types of assets and because of this, I wanted to understand Sotheby’s valuation framework and explore how it could be applied to unique digital assets.

Sotheby’s Valuation Framework

Sotheby’s has a comprehensive list of ten factors to use when valuing anything from art to wine, but for this example, we will focus on artwork. Let's dive in and examine the framework.

Authenticity

Authenticity is an obvious, but essential, part of an artwork’s valuation. If an artwork is not an original piece from a specific artist, then it will not be valued highly or at all.

Condition

Condition is more interesting because although the majority of people prefer art pieces in pristine condition, some stylistically prefer pieces to look weathered or aged. Thus, artwork condition preference is determined by the specific owner or market.

Rarity

Rarity introduces classic supply and demand. It is human nature to want things that others want, and desire them more when they are scarce. For example, one unique piece of art is considered more valuable than ten pieces of identical art.

Provenance

Provenance refers to the official record and story of ownership. For example, a piece of art once owned by the King of England and given to George Washington would be highly valued, regardless of who created it.

Historical Importance

Historical importance refers to the actual historical significance of the artwork the day it was created. Books are a great example: Books can be reprinted again and again but the first 100 books ever created are likely immensely valuable since books have played such a significant role throughout our history.

Size

Size is a simple criteria to understand: generally the bigger the better. There is a direct positive correlation between the size of an artwork and its value.

Fashion

Fashion relates to current trends. Occasionally abstract paintings start trending and become more valuable, while other times portrait paintings steal the spotlight. Fashion criteria are unpredictable because it is not necessarily determined by logic or reason.

Subject Matter

Subject matter is the scene or image shown on the art. Subject matter varies widely: It can be a simple black canvas or a detailed ancient Greek battle scene.

Medium

The medium is what the artist uses to create their art. It can be anything the artist desires, such as paint on canvas, marble sculpture, or folded origami paper.

Quality

Quality, the final criteria, is probably the most subjective. In essence, quality is the distinct characteristics or attributes of the art piece. For example, an artist may become famous for painting with specific brush strokes. Thus, this specific quality of brush stroke would increase the value of the artist’s work.

These ten metrics complete Sotheby’s valuation framework. Obviously not all metrics will directly apply to digital assets, however, this acclaimed framework can still be used as inspiration for a digital asset valuation framework. We will now examine each metric and determine whether to keep it or change it.

1. Authenticity: Keep It

Figuring out the authenticity of a digital asset is extremely easy if the asset is blockchain-based. To uncover the details of a blockchain-based digital asset one can simply look up the transaction data. Let’s examine the authenticity of CryptoKitty, “SploitCat.”

SploitCat’s “Offer History” can be found on OpenSea. Scrolling to the bottom of the Offer History shows “Birth”, and clicking the date will open a block explorer that transparently shows the blockchain and all transactions. In this case, SploitCat is on the Ethereum blockchain and Etherscan is the block explorer. Etherscan can confirm that this is an authentic asset on the Ethereum blockchain.

With non-blockchain-based digital assets, like Fortnite skins, it is very difficult to discern if the asset is real unless it is being sold directly from the game developer. A major downside of non-blockchain-based digital assets is that they can be deleted if the developer goes out of business or simply wants to delete them. Of course, if the developer of a blockchain-based asset goes out of business the value of a digital item will likely drop, but at least the owner will still have direct ownership.

2. Condition: Change It to… Database

The condition of a digital asset cannot change. There is no way that unique digital goods can weather with age, get water damage, or lose material from the piece. In some aspects, this is negative because the asset feels less real, but overall it's positive since they can last forever. Therefore let's dispose of the condition metric and replace it with “database.” This refers to the type of database the asset is stored on. For example, is the asset stored on a traditional centralized database where the developers have control or is this asset stored on a blockchain where the user has sovereignty? This closely relates to condition because I consider digital assets that are on a centralized database, like Fortnite skin, to be in bad condition and not fit for resale. On the contrary, I’d consider an asset on a blockchain in good condition and fit for resale.

3. Rarity: Keep It

Rarity is an essential metric that easily applies to both physical and digital assets. People are hardwired to prefer rare things. It’s easier to determine the rarity of a digital asset than a physical asset because you can inspect the code and view exactly how many of that digital item exists. Developers of non-blockchain-based digital assets can create more assets at any time and diminish the rarity. Developers of blockchain-based digital assets can indicate in the code the maximum number of assets that can be created. This transparency increases buyer confidence that an item is truly rare. Of course, the blockchain-based asset developer could potentially make an asset that is an identical “Version 2” of the rare asset. Luckily, an examination of the asset’s genetics (code) will show a distinction between Version 1 and Version 2.

Many blockchain-based digital assets will have properties that transparently reveal their rarity. If we examine the CryptoKitty “Vulcat” below, we can observe its rare properties.

Vulcat has a number of properties that are extremely rare within the CryptoKitties ecosystem. For example:

6% of Cryptokitties have the Swift trait

0.02% of Cryptokitties have the Exclusive trait

6% of Cryptokitties have the Fancy trait

There is only 1 Vulcat CryptoKitty

Fancy Ranking is 1 out of 10,000

Even without being a Cryptokitties expert, this data clearly indicates that this CryptoKitty is extremely rare. Data transparency like this is what makes determining rarity for blockchain-based digital assets so effective.

4. Provenance: Keep It

Provenance is exceptionally important but is hard to track, even for assets on a blockchain. Most blockchains use “addresses” where users can send and receive assets. Addresses are generally a long string of numbers and letters, so it is very difficult to determine who exactly you are transacting with. You can easily determine all other relevant information, like date of transaction, asset price, asset type, etc., but you can only uncover the previous owner if you know their blockchain address which is unlikely. Regardless of the difficulty, owning a digital asset that was once owned by an important figure would likely impact the asset value.

5. Historical Importance: Keep It

The blockchain is a perfect record keeper: it records all transactions and transfers in an open database. Digital assets are still in their infancy, but as the ecosystem grows larger their historical importance will increase and so will their value. Similar to how owning one of the first books ever made would be unbelievably valuable, owning one of the first mainstream digital assets could also be incredibly valuable. However, the historical importance of a digital asset can be valuable even without millions of users. Even though CryptoKitties has less than 100,000 users, this CryptoKitty below sold for roughly $100,000 because of its historical significance.

This asset has historical importance because of its token ID. Token ID indicates when an asset was created: assets with a lower token ID were created before assets with a higher token ID. This CryptoKitty has a historically significant token ID of 1.

6. Size: Change It to… Data

Although size still pertains to digital worlds that have a sense of scale, like Cryptovoxels or Decentraland, this criteria should be changed to “data.” Data is a broad category, but for this example, it refers to all the relevant data surrounding the asset, such as:

Creation Date

Token ID

Number of Transfers

Database Type

If blockchain, which one?

Previous Sale Price

Asset Properties

Number of Visits/Views

Many More..

Although these data points may overlap with other criteria in this valuation framework, it is still necessary to have a dedicated data section since it is so important.

7. Fashion: Change It to… Visits or Views

Fashion can be determined with digital assets by quantifying page visits or views. If we can view the number of visitors that come to a specific webpage with a digital asset on it, we can determine what is in fashion if the number of views starts to increase. If an asset that typically gets five daily views begins to receive hundreds, it would indicate that the asset is becoming increasingly popular. Once the views slow down, it would indicate that the asset is losing its fashion and there is likely a new rising asset.

8. Subject Matter: Keep It

Subject matter criteria is still relevant since digital assets have observable subject matter. For example, consider this digital asset from the game CryptoSpaceCommanders.

This asset is a “Sigma Battlecruiser” which is used within the world of CryptoSpaceCommanders. The subject matter shows a large spaceship floating in space. The bright red colors and angular lines make the spaceship stand out against the black darkness. The subject looks quite formidable and exudes a sense of power. Clearly, subject matter is subjective to the viewer.

9. Medium: Keep It

Surprisingly, medium criteria makes sense even in a digital format because it can refer to the type of program used to create the asset. Physical art can be made from multiple sources (paint, paper, clay, and more) and the same is true for digital assets. Digital mediums include Photoshop, Unity, Blender, Sketch, Magicavoxel, and more. There is constantly new design software emerging to create all types of digital assets, each with their own pros and cons just like physical mediums.

10. Quality: Change It to… Functionality

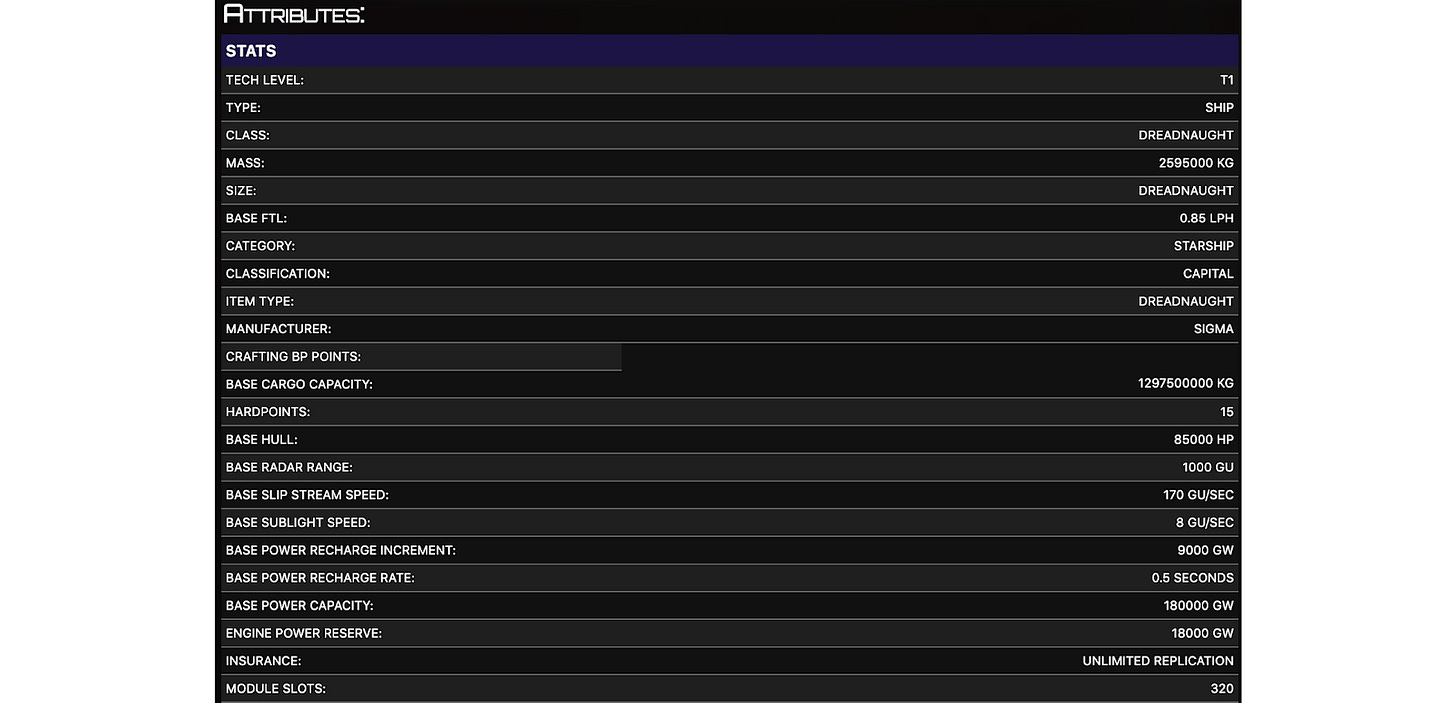

Quality works great with physical items, but is harder to determine with digital. Functionality is more applicable to digital items because they can have distinct uses. A digital artwork that moves in a GIF format to show a scene displays a sense of functionality because it serves to better immerse a viewer. Building a casino on a piece of virtual land would also add functionality and distinction. Let’s observe the functionality of the “Sigma Battlecruiser” below.

The CryptoSpaceCommander website shows stats that indicate the spaceship is powerful - a fact I double-checked with the CryptoSpaceCommander Discord chat. In this case, power translates to functionality because the more powerful the spaceship, the more useful it is in-game. Functionality comes in all shapes and sizes so it must be assessed on a case-by-case basis, nevertheless it is one of the most important factors when valuing digital assets.

It is incredible that the majority of Sotheby’s valuation metrics can be used for valuing unique digital assets. I wonder how long it will take for Sotheby’s to focus on the unique digital asset space.😉

A big thank you to Sotheby’s, CryptoKitties, CryptoSpaceCommanders and OpenSea for having data and information freely available on their websites so I could make this article.

If you liked this content, please subscribe to my newsletter, Zima Red, and give me a follow on Twitter. Stay tuned for more articles on unique digital assets and all things virtual. 😎