🕵️♂️⛓📊Exploring On-Chain Data To Find The Best NFT Traders

🚀Huge thank you to the 73 new subscribers who signed up in the past two weeks! I have noticed a recent sharp increase in subscribers which means that people are getting pumped up about NFTs and the metaverse!! This excitement makes me even more motivated to keep exploring this weird and wonderful ecosystem. Sign up now 🚀

Today’s sponsor is the 🔥 Zima Red podcast 🔥 Check it out if you want to learn from the creatives and builders that are driving our ecosystem forward.

🕵️♂️⛓📊Exploring On-Chain Data To Find The Best NFT Traders

I have always been curious about who the best NFT traders are and what they are trading. To uncover this, I reached out to NFTbank.ai and asked them to help me collect and understand the data. They sent me an entire Google Doc filled with amazing insights, so I owe them a big thank you. This is not a sponsored post, but I highly suggest you check them out here. NFTbank.ai is an NFT portfolio tracking and analytics tool that allows users to connect their wallet to instantly see their profit/loss. They also conveniently share detailed information about the NFT projects that users hold in their wallet. Check it out!

Now let’s get down to business and check out the top ten traders in the NFT ecosystem. All of the data referenced in this article is pulled from January 2018 to August 2020. Also, keep in mind that this data is pulled from single wallets. There are many NFT traders that use multiple wallets, but this list focuses only on traders using the same wallet. Now without further adieu, the top ten NFT traders are:

567.15 ETH cumulative profit - DirtyFox

452.13 ETH cumulative profit - Slats.eth

436.11 ETH cumulative profit - Wallet #3

220.13 ETH cumulative profit - PeterD

171.91 ETH cumulative profit - ChrisR

155.16 ETH cumulative profit - Michaelcharest.eth

140.21 ETH cumulative profit - Smolpp.eth

135.62 ETH cumulative profit - Bullauge

135.58 ETH cumulative profit - Chrisbell

126.60 ETH cumulative profit - Plr82

This cumulative profit number is calculated by: profit = selling price - acquisition price

Before diving deeper into the data, let's look at the categories that NFTbank.ai uses to organize different NFT projects.

If we break down asset ownership to uncover which category was the most popular purchase for NFT traders, a clear outlier emerges.

NFT Buys

“Estate,” or virtual land, is clearly the most purchased NFT asset, with traders owning roughly 6,410 virtual land-related NFTs. Coming in second place is the “strategy” (or gaming) category, but interestingly traders only purchased 2,229 of these assets. Even if we doubled the strategy category, then it still would not reach the estate category. This shows the sheer dominance of virtual land in the NFT ecosystem.

NFT Sells

If we examine which type of NFT asset was sold the most, the results are surprising.

NFT traders sold more strategy NFTs than estate NFTs. I am not entirely sure why, but I would guess that NFT projects in the strategy category often encounter time periods where they are “hot” and the trading activity explodes. After time, the volume drops and the market activity slows down significantly. I would imagine that during these frenzy periods, traders sell assets at a fast pace. This is unlike virtual land, which encounters less frenzy and usually takes longer to gain value. Again, this is all just a guess as to why strategy NFTs outsell estate NFTs. I want to be clear that I do not know why with any certainty.

Which NFT category provided the most cumulative return? These results are also surprising.

Total Cumulative Profit

Virtual real estate completely dominated the total returns, with a cumulative profit of 2,320.64 ETH. Strategy came in second place, with a comparatively tiny 143.3 ETH. You would think that since strategy assets are sold at a higher rate than estate assets that the profit would be comparable, but that is not the case. This information tells me that strategy assets are likely to consist of many low-cost items. It also signals that estate assets are highly profitable. To see if this thesis is correct, let’s breakdown the profit per project.

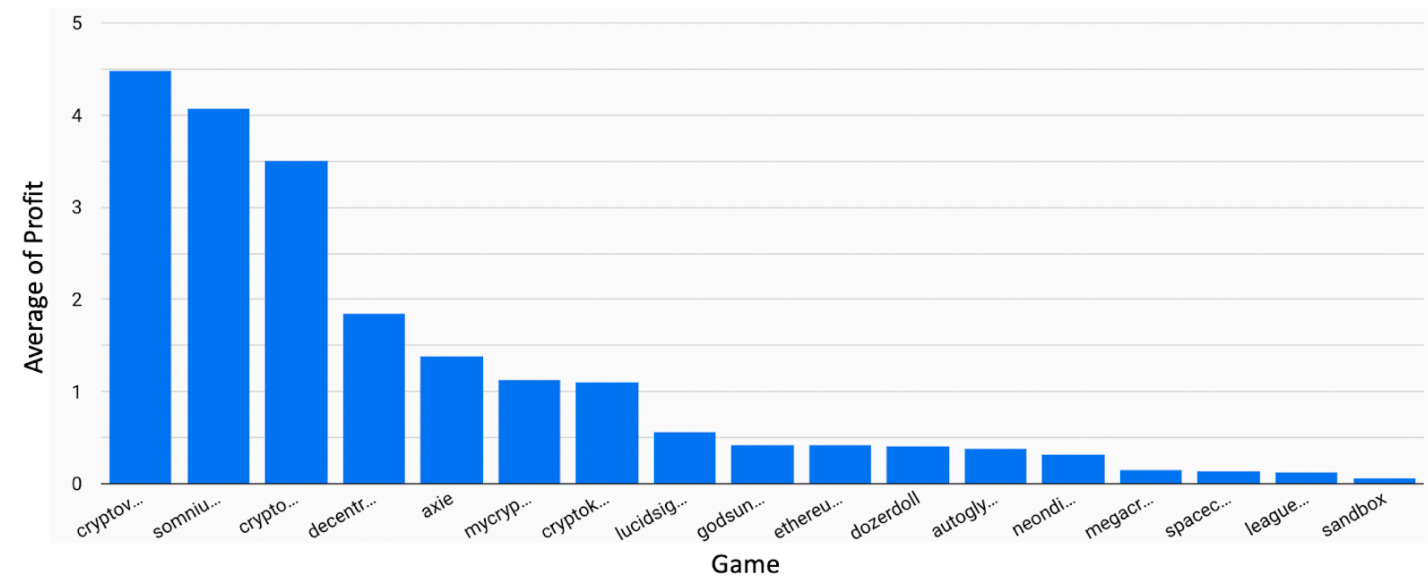

The above chart shows the total cumulative profit per project. We can see that estate projects (Somnium Space, Decentraland, Cryptovoxels) completely dominated, with over 85% of the total cumulative profit.

Another interesting bit of information that appears from examining the average profit per sold asset is that Cryptovoxels is actually the most profitable NFT project on average, with an average profit of 4.48 ETH. This is interesting because Cryptovoxels is in third place in total cumulative profit. The above chart also shows an outlier: Cryptomotors is in third place for the highest average profit, even though it is in the “other” category (which is not a strong overall category).

So what did we learn by looking at the most successful NFT traders? Virtual land is by far the best performing asset in the NFT ecosystem. If you want to learn more about why that is, then I recommend you dive into the number of blogs I have written about virtual real estate:

Why Blockchain-Based Virtual Worlds Will Accrue The Greatest Aggregate Value Within The NFT Space

The “Scarce” Web - The blockchain-based virtual world revolution

Blockchain-Based Virtual Worlds As The Next Gaming Platforms

I plan to write another blog post in the future that explores the trading behavior of the top 10 NFT traders. Subscribe so you don’t miss it!

If you liked this content please subscribe to my newsletter, Zima Red, and give me a follow on Twitter. Stay tuned for more articles on esoteric digital assets and all things virtual 😎